Report-Amit_Brahme

Report on Webinar held at 3:00 pm on July 11, 2020.

The COVID 19 pandemic has brought unprecedented challenges to every country in the world, since all the countries are facing similar challenges, therefore knowledge sharing on the approaches and measures in dealing with covid-19 pandemic among the countries and stakeholders is critical for their effective response and swift recovery from the crisis. IMDR has started a new series of meet-up for our students, wherein, resource persons who are witnessing such economic upheavals in different parts of the country will join us to share how business and economies are preparing to unlock and overcome the challenges in from of them.

Under this initiative IMDR Pune invited Mr. Amit Brahme form Canada on Saturday, 11th July 2020, who is currently working with Royal Bank of Canada as a Senior Director leading strategy teams in Newcomer Client Segment. He is alumnus from PGDM Batch of 1996-98 . The webinar was conducted for the students of PGDM-II. He discussed about his significant learning from his alma-mater IMDR Pune.

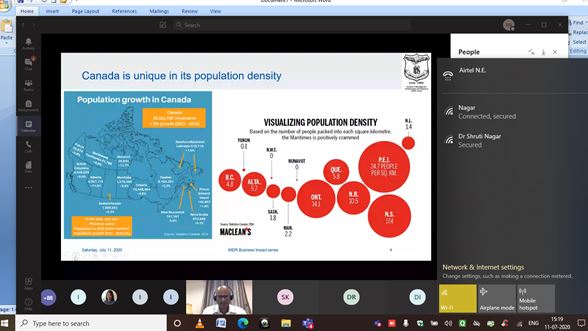

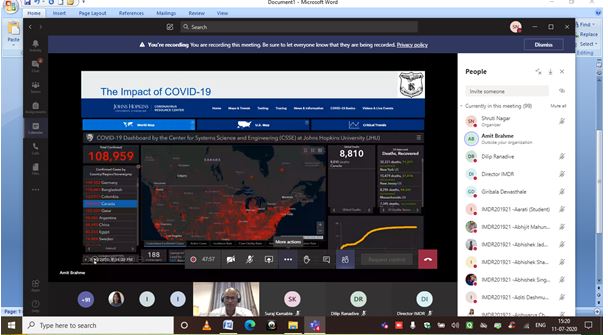

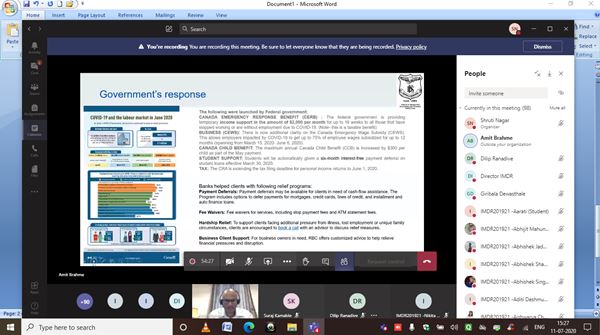

He extensively shared his insights on Canadian economy, its uniqueness and the present economic scenario with the help of some vital macroeconomic parameters. He discussed about the impact of pandemic on the different sectors in Canada and also about the measures taken by the Federal government to cope up with the situation.

He shared an initiative taken by the Royal Bank of Canada to help the clients such as payment deferrals, fee waivers, hardship reliefs and business client support. He gave an insight about his first hand experiences to handle the unprecedented challenges posed by pandemic and the way how the whole set of banking operations had to shift to remote working mode. He highlighted the difficulties faced by bank employees during this transition, and how the varieties of solutions have been provided to ensure the efficiency in work. He shared the steps taken by the bank to use this obstacle as an opportunity and adoption of automation in banking operations to higher level.

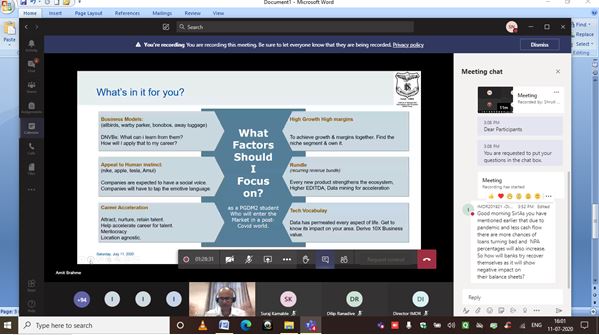

He advised the students to be more focussed to business models, appeal to human instinct, tech vocabulary and to have better understanding of rundle, i.e recurring revenue bundle.

The session was very enriching for all the participants. The students asked variety of questions, which were answered very meticulously by Mr. Brahme. The participants took some valuable takeaways from the discussion.