Page 81 - IMDR MSME BOOK 2021

P. 81

Managing Finance in Micro, Small & Medium Enterprises

P value is less than 0.05 which makes us reject the null

hypothesis and concludes that there is a signicant

association between increase in NPAT and periodic

variance analysis. It is concluded that the rms which

are conducting variance analysis periodically have

reported increase in their net prot after tax.

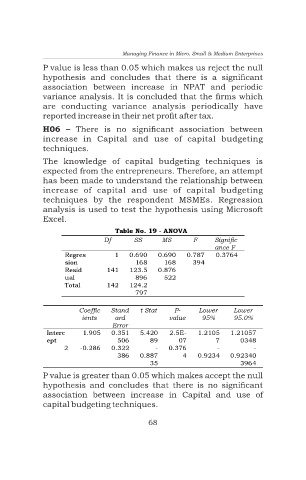

H06 – There is no signicant association between

increase in Capital and use of capital budgeting

techniques.

The knowledge of capital budgeting techniques is

expected from the entrepreneurs. Therefore, an attempt

has been made to understand the relationship between

increase of capital and use of capital budgeting

techniques by the respondent MSMEs. Regression

analysis is used to test the hypothesis using Microsoft

Excel.

P value is greater than 0.05 which makes accept the null

hypothesis and concludes that there is no signicant

association between increase in Capital and use of

capital budgeting techniques.