Page 145 - Abhivruddhi

P. 145

The previous peak in this industry was ₹4.80 trillion which was

witnessed in 2017, followed by ₹4.5 trillion in 2020, the gain in the

industry accounted for22% in 2021 compared with 17% in 2020. The

reports shared by CRISIL highlighted the change in strategic pattern of

investors as year 2020 investors preferred debt-oriented mutual funds

whereas in 2021 witnessed equity-oriented mutual funds cornering the

bulk.

The tremendous growth of Indian equity market was relished by the

investors through equity-oriented mutual funds in the 2021.It has been

observed that investors put their big chunk of investible funds in equity

oriented funds, and without taking high risk of entering through equity

route, they have generated high return on mutual funds due to the strong

gains in the underlying equity market. The net inflow of Rs.91000 crores

has been seen in equity mutual funds whereas passive funds got ₹1.14

trillion and hybrid funds ₹1.02 trillion.

In 2021, the assets of Exchange-traded funds increased to surpass liquid

funds as the largest MF category, the assets of liquid funds were closed in

2021 with ₹3.61 trillion whereas the assets for ETF was closed with assets

of ₹3.84 trillion . The liquid funds failed to generate high returns due to

low interest rate, which made liquid funds to be less attractive for the

investors with high risk appetite and high level of expected returns on

investment.

The mutual fund industry reported net inflows of ₹1.14 trillion in 2021

through systematic investment plans (SIPs), crossing the ₹1 trillion mark

for the first time.In November 2021. SIP crossed the the ₹11,000-crore

mark for the first time and in December it touched record breaking

monthly inflow high of ₹11,300 crore.

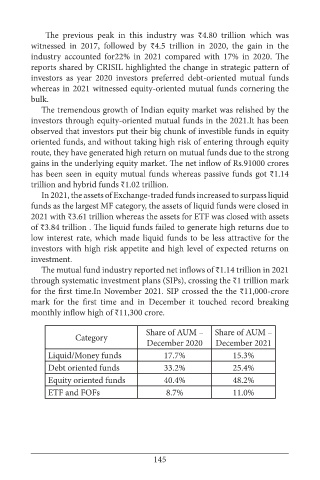

Share of AUM – Share of AUM –

Category

December 2020 December 2021

Liquid/Money funds 17.7% 15.3%

Debt oriented funds 33.2% 25.4%

Equity oriented funds 40.4% 48.2%

ETF and FOFs 8.7% 11.0%

145