Page 7 - IMDR - Journal of Management Development and Research - March2019-20

P. 7

3. Financing opportunities: - Tie-ups with new-age non-banking finance

(FinTech) companies allowed access to timely collateral free finance to

MSMEs.

4. Changing employment patterns: Younger generation shifting from agriculture

towards entrepreneurial activities creating job prospects for others.

5. Boost in export activities: - 45% of overall export contribute comes from

MSMEs sector (2019)

OBJECTIVE OF THE STUDY: -

1. To study the overall problems faced by MSMEs in India.

2. To understand the impact of Union Budget 2020 on MSMEs in India.

RESEARCH METHODOLOGY: -

The study is based on secondary data that has been collected from various

secondary sources such as magazines, annual report of MSMEs 2018-2019,

department of MSMEs & various other published reports. The data has been

presented in the form of table and interpretations have been made in light of the

objectives of the study cited above.

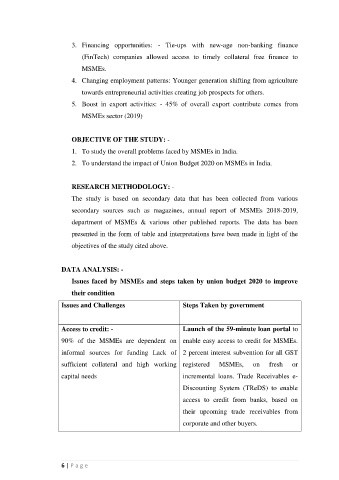

DATA ANALYSIS: -

Issues faced by MSMEs and steps taken by union budget 2020 to improve

their condition

Issues and Challenges Steps Taken by government

Access to credit: - Launch of the 59-minute loan portal to

90% of the MSMEs are dependent on enable easy access to credit for MSMEs.

informal sources for funding Lack of 2 percent interest subvention for all GST

sufficient collateral and high working registered MSMEs, on fresh or

capital needs incremental loans. Trade Receivables e-

Discounting System (TReDS) to enable

access to credit from banks, based on

their upcoming trade receivables from

corporate and other buyers.

6 | P a g e