Page 46 - MUDRA ANUBHAV

P. 46

Kishor Loan:

Based on Number of Accounts

In the period of four years 2015-16 to 2018-19,

the majority of Indian states and Union Territories

have shown the tremendous increase in number

of Kishore loan accounts, such as Chandigarh,

Chhattisgarh, Dadar & Nagar Haveli, Jammu &

Kashmir, Himachal Haryana, Madhya Pradesh,

Maharashtra etc.

But in the year 2019-20, the majority of the States

and UTs have shown declining trends. The reason

may be the pandemic situation and lockdowns

which has adversely affected the economy of the

nation.

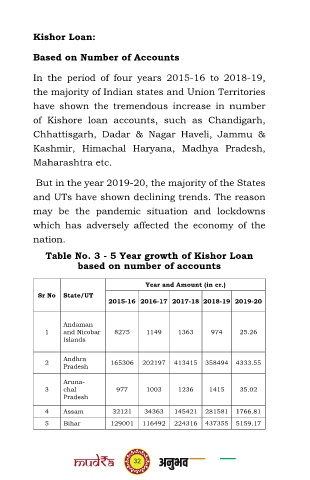

Table No. 3 - 5 Year growth of Kishor Loan

based on number of accounts

Year and Amount (in cr.)

Sr No State/UT

2015-16 2016-17 2017-18 2018-19 2019-20

Andaman

1 and Nicobar 8275 1149 1363 974 25.26

Islands

Andhra

2 165306 202197 413415 358494 4333.55

Pradesh

Aruna-

3 chal 977 1003 1236 1415 35.02

Pradesh

4 Assam 32121 34363 145421 281581 1766.81

5 Bihar 129001 116492 224316 437355 5159.17

32