Page 122 - Abhivruddhi

P. 122

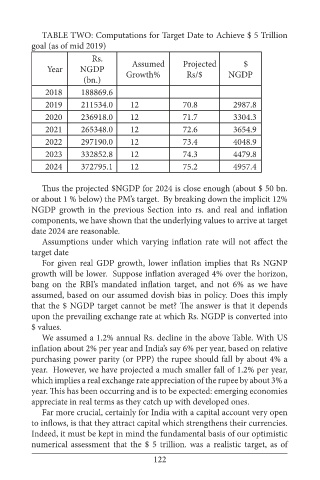

TABLE TWO: Computations for Target Date to Achieve $ 5 Trillion

goal (as of mid 2019)

Rs.

Year NGDP Assumed Projected $

(bn.) Growth% Rs/$ NGDP

2018 188869.6

2019 211534.0 12 70.8 2987.8

2020 236918.0 12 71.7 3304.3

2021 265348.0 12 72.6 3654.9

2022 297190.0 12 73.4 4048.9

2023 332852.8 12 74.3 4479.8

2024 372795.1 12 75.2 4957.4

Thus the projected $NGDP for 2024 is close enough (about $ 50 bn.

or about 1 % below) the PM’s target. By breaking down the implicit 12%

NGDP growth in the previous Section into rs. and real and inflation

components, we have shown that the underlying values to arrive at target

date 2024 are reasonable.

Assumptions under which varying inflation rate will not affect the

target date

For given real GDP growth, lower inflation implies that Rs NGNP

growth will be lower. Suppose inflation averaged 4% over the horizon,

bang on the RBI’s mandated inflation target, and not 6% as we have

assumed, based on our assumed dovish bias in policy. Does this imply

that the $ NGDP target cannot be met? The answer is that it depends

upon the prevailing exchange rate at which Rs. NGDP is converted into

$ values.

We assumed a 1.2% annual Rs. decline in the above Table. With US

inflation about 2% per year and India’s say 6% per year, based on relative

purchasing power parity (or PPP) the rupee should fall by about 4% a

year. However, we have projected a much smaller fall of 1.2% per year,

which implies a real exchange rate appreciation of the rupee by about 3% a

year. This has been occurring and is to be expected: emerging economies

appreciate in real terms as they catch up with developed ones.

Far more crucial, certainly for India with a capital account very open

to inflows, is that they attract capital which strengthens their currencies.

Indeed, it must be kept in mind the fundamental basis of our optimistic

numerical assessment that the $ 5 trillion. was a realistic target, as of

122