Page 108 - IMDR JOURNAL 2023-24

P. 108

IMDR’s Journal of Management Development & Research 2023-24

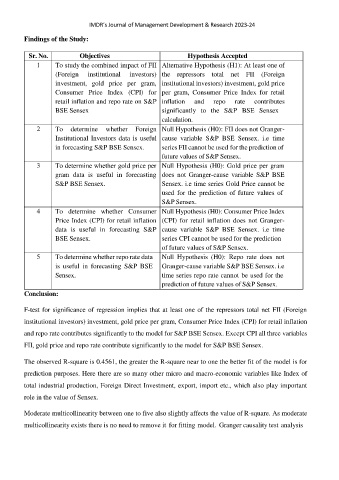

Findings of the Study:

Sr. No. Objectives Hypothesis Accepted

1 To study the combined impact of FII Alternative Hypothesis (H1): At least one of

(Foreign institutional investors) the repressors total net FII (Foreign

investment, gold price per gram, institutional investors) investment, gold price

Consumer Price Index (CPI) for per gram, Consumer Price Index for retail

retail inflation and repo rate on S&P inflation and repo rate contributes

BSE Sensex significantly to the S&P BSE Sensex

calculation.

2 To determine whether Foreign Null Hypothesis (H0): FII does not Granger-

Institutional Investors data is useful cause variable S&P BSE Sensex. i.e time

in forecasting S&P BSE Sensex. series FII cannot be used for the prediction of

future values of S&P Sensex.

3 To determine whether gold price per Null Hypothesis (H0): Gold price per gram

gram data is useful in forecasting does not Granger-cause variable S&P BSE

S&P BSE Sensex. Sensex. i.e time series Gold Price cannot be

used for the prediction of future values of

S&P Sensex.

4 To determine whether Consumer Null Hypothesis (H0): Consumer Price Index

Price Index (CPI) for retail inflation (CPI) for retail inflation does not Granger-

data is useful in forecasting S&P cause variable S&P BSE Sensex. i.e time

BSE Sensex. series CPI cannot be used for the prediction

of future values of S&P Sensex.

5 To determine whether repo rate data Null Hypothesis (H0): Repo rate does not

is useful in forecasting S&P BSE Granger-cause variable S&P BSE Sensex. i.e

Sensex. time series repo rate cannot be used for the

prediction of future values of S&P Sensex.

Conclusion:

F-test for significance of regression implies that at least one of the repressors total net FII (Foreign

institutional investors) investment, gold price per gram, Consumer Price Index (CPI) for retail inflation

and repo rate contributes significantly to the model for S&P BSE Sensex. Except CPI all three variables

FII, gold price and repo rate contribute significantly to the model for S&P BSE Sensex.

The observed R-square is 0.4561, the greater the R-square near to one the better fit of the model is for

prediction purposes. Here there are so many other micro and macro-economic variables like Index of

total industrial production, Foreign Direct Investment, export, import etc., which also play important

role in the value of Sensex.

Moderate multicollinearity between one to five also slightly affects the value of R-square. As moderate

multicollinearity exists there is no need to remove it for fitting model. Granger causality test analysis