Page 142 - IMDR JOURNAL 2023-24

P. 142

IMDR’s Journal of Management Development & Research 2023-24

Quantitative analysis is undertaken using statistical tools such as R or Python to backtest each trading strategy

against historical market data. This entails measuring performance parameters like returns, volatility,

drawdowns, and Sharpe ratios to evaluate the strategy's profitability and risk-adjusted performance over

various time periods and market situations.

Qualitative analysis:

In-depth interviews with experienced traders, market analysts, and industry experts are undertaken to gain

qualitative insights into each trading strategy's actual implementation in the Indian stock market. These

interviews provide useful insights into traders' experiences, obstacles, and opinions on the efficacy and

applicability of each approach.

Comparative analysis:

The performance of each trading method is compared and assessed using quantitative measures derived from

backtesting and qualitative insights gleaned from expert interviews. This comparative analysis provides a

thorough review of each strategy's merits, flaws, and practical ramifications.

Validation and interpretation:

The quantitative analysis findings and qualitative insights are confirmed and analyzed to draw meaningful

conclusions regarding each trading strategy's effectiveness and usefulness in navigating the Indian stock

market. These conclusions are supported by empirical evidence and expert perspectives, and they offer

actionable advice to traders, investors, and policymakers.

Discussion:

I'm going to go over 3 stock market strategies with you now to help you become a pro trader.

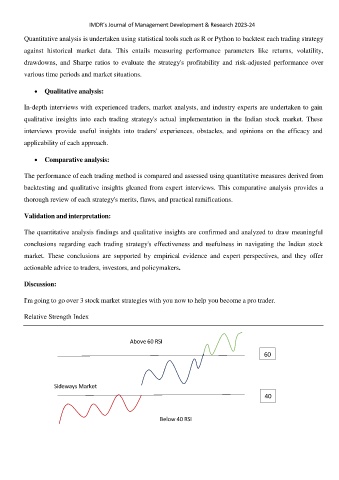

Relative Strength Index

Above 60 RSI

60

Sideways Market

40

Below 40 RSI