Page 19 - IMDR EBOOK 20 OCT 2020

P. 19

"Pandemic and Beyond: Naviga ng the New Normal" E - Book Year 2020

Overall it appears that companies are struggling to recover xed costs in the absence of

revenue generation due to sharp drop in sales. The reduction in costs is more by default

than design, owing to the changed circumstances of the pandemic. Increase in costs are

due to enablement of digital platforms, increased freight and cartage costs and increased

costs of raw materials.

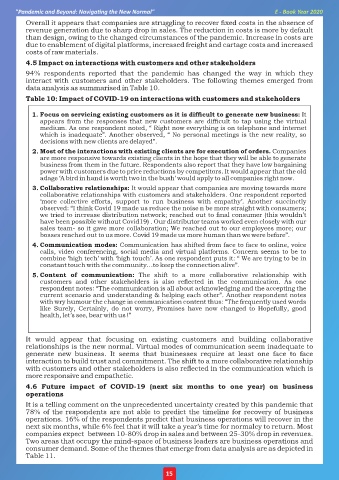

4.5 Impact on interactions with customers and other stakeholders

94% respondents reported that the pandemic has changed the way in which they

interact with customers and other stakeholders. The following themes emerged from

data analysis as summarised in Table 10.

Table 10: Impact of COVID-19 on interactions with customers and stakeholders

1. Focus on servicing existing customers as it is difcult to generate new business: It

appears from the responses that new customers are difcult to tap using the virtual

medium. As one respondent noted, “ Right now everything is on telephone and internet

which is inadequate”. Another observed, “ No personal meetings is the new reality, so

decisions with new clients are delayed”.

2. Most of the interactions with existing clients are for execution of orders. Companies

are more responsive towards existing clients in the hope that they will be able to generate

business from them in the future. Respondents also report that they have low bargaining

power with customers due to price reductions by competitors. It would appear that the old

adage ‘A bird in hand is worth two in the bush’ would apply to all companies right now.

3. Collaborative relationships: It would appear that companies are moving towards more

collaborative relationships with customers and stakeholders. One respondent reported

‘more collective efforts, support to run business with empathy’. Another succinctly

observed: “I think Covid 19 made us reduce the noise n be more straight with consumers;

we tried to increase distribution network; reached out to nal consumer (this wouldn’t

have been possible without Covid19) . Our distributor teams worked even closely with our

sales team- so it gave more collaboration; We reached out to our employees more; our

bosses reached out to us more. Covid 19 made us more human than we were before”.

4. Communication modes: Communication has shifted from face to face to online, voice

calls, video conferencing, social media and virtual platforms. Concern seems to be to

combine ‘high tech’ with ‘high touch’. As one respondent puts it: “ We are trying to be in

constant touch with the community…to keep the connection alive”.

5. Content of communication: The shift to a more collaborative relationship with

customers and other stakeholders is also reected in the communication. As one

respondent notes: “The communication is all about acknowledging and the accepting the

current scenario and understanding & helping each other”. Another respondent notes

with wry humour the change in communication content thus: “The frequently used words

like Surely, Certainly, do not worry, Promises have now changed to Hopefully, good

health, let’s see, bear with us !”

It would appear that focusing on existing customers and building collaborative

relationships is the new normal. Virtual modes of communication seem inadequate to

generate new business. It seems that businesses require at least one face to face

interaction to build trust and commitment. The shift to a more collaborative relationship

with customers and other stakeholders is also reected in the communication which is

more responsive and empathetic.

4.6 Future impact of COVID-19 (next six months to one year) on business

operations

It is a telling comment on the unprecedented uncertainty created by this pandemic that

78% of the respondents are not able to predict the timeline for recovery of business

operations. 16% of the respondents predict that business operations will recover in the

next six months, while 6% feel that it will take a year’s time for normalcy to return. Most

companies expect between 10-80% drop in sales and between 25-30% drop in revenues.

Two areas that occupy the mind-space of business leaders are business operations and

consumer demand. Some of the themes that emerge from data analysis are as depicted in

Table 11.

15