Page 69 - MUDRA ANUBHAV

P. 69

the loan under PMMY, followed by the business

with the age up to 10 years (Figure No.17). With

the time entrepreneurs are getting experience to

manage finances well in their business and are able

to tap other sources of finance available in formal

and informal financial system.

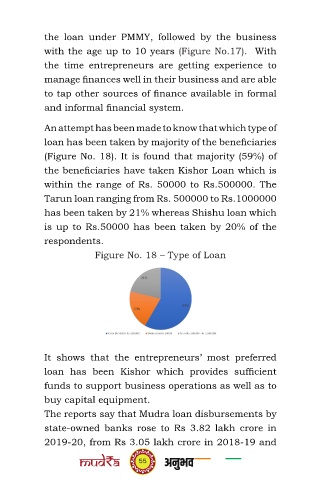

An attempt has been made to know that which type of

loan has been taken by majority of the beneficiaries

(Figure No. 18). It is found that majority (59%) of

the beneficiaries have taken Kishor Loan which is

within the range of Rs. 50000 to Rs.500000. The

Tarun loan ranging from Rs. 500000 to Rs.1000000

has been taken by 21% whereas Shishu loan which

is up to Rs.50000 has been taken by 20% of the

respondents.

Figure No. 18 – Type of Loan

It shows that the entrepreneurs’ most preferred

loan has been Kishor which provides sufficient

funds to support business operations as well as to

buy capital equipment.

The reports say that Mudra loan disbursements by

state-owned banks rose to Rs 3.82 lakh crore in

2019-20, from Rs 3.05 lakh crore in 2018-19 and

55