Page 94 - MUDRA ANUBHAV

P. 94

their institutions. To avoid the manipulation of

response, due to fear of actions, the respondents

were given a choice to stay anonymous during the

survey, so that the responses are truthful. The

analysis of their responses are shared below.

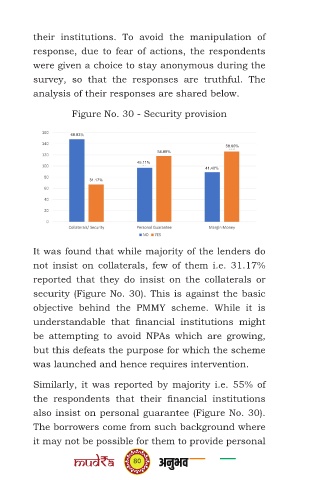

Figure No. 30 - Security provision

68.83%

58.60%

54.89%

45.11%

41.40%

31.17%

It was found that while majority of the lenders do

not insist on collaterals, few of them i.e. 31.17%

reported that they do insist on the collaterals or

security (Figure No. 30). This is against the basic

objective behind the PMMY scheme. While it is

understandable that financial institutions might

be attempting to avoid NPAs which are growing,

but this defeats the purpose for which the scheme

was launched and hence requires intervention.

Similarly, it was reported by majority i.e. 55% of

the respondents that their financial institutions

also insist on personal guarantee (Figure No. 30).

The borrowers come from such background where

it may not be possible for them to provide personal

80