Page 92 - MUDRA ANUBHAV

P. 92

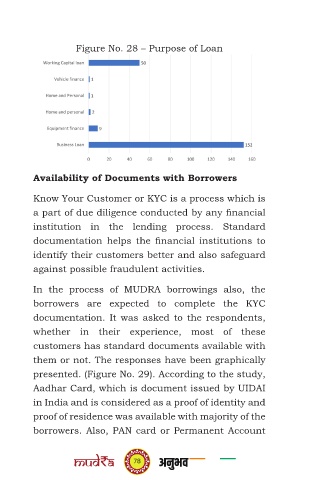

Figure No. 28 – Purpose of Loan

Availability of Documents with Borrowers

Know Your Customer or KYC is a process which is

a part of due diligence conducted by any financial

institution in the lending process. Standard

documentation helps the financial institutions to

identify their customers better and also safeguard

against possible fraudulent activities.

In the process of MUDRA borrowings also, the

borrowers are expected to complete the KYC

documentation. It was asked to the respondents,

whether in their experience, most of these

customers has standard documents available with

them or not. The responses have been graphically

presented. (Figure No. 29). According to the study,

Aadhar Card, which is document issued by UIDAI

in India and is considered as a proof of identity and

proof of residence was available with majority of the

borrowers. Also, PAN card or Permanent Account

78