Page 87 - MUDRA ANUBHAV

P. 87

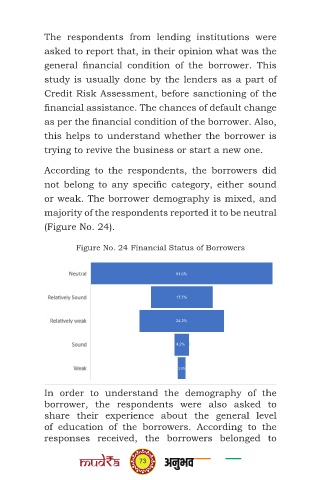

The respondents from lending institutions were

asked to report that, in their opinion what was the

general financial condition of the borrower. This

study is usually done by the lenders as a part of

Credit Risk Assessment, before sanctioning of the

financial assistance. The chances of default change

as per the financial condition of the borrower. Also,

this helps to understand whether the borrower is

trying to revive the business or start a new one.

According to the respondents, the borrowers did

not belong to any specific category, either sound

or weak. The borrower demography is mixed, and

majority of the respondents reported it to be neutral

(Figure No. 24).

Figure No. 24 Financial Status of Borrowers

51.6%

17.7%

24.2%

4.2%

2.3%

In order to understand the demography of the

borrower, the respondents were also asked to

share their experience about the general level

of education of the borrowers. According to the

responses received, the borrowers belonged to

73