Page 334 - IMDR JOURNAL 2023-24

P. 334

IMDR’s Journal of Management Development & Research 2023-24

In contrast, Sharma and Verma (2019) conducted a long-term analysis over a 11 years period,

employing statistical techniques such as cointegration analysis. Their study identified a

significant long-term correlation between the Nasdaq and Nifty indices. This long-term

perspective allowed them to assess the stability and sustainability of the correlation,

providing insights into portfolio diversification strategies.

Furthermore, Gupta et al. (2020) investigated the impact of global market movements on the

Indian stock market, including those of the Nasdaq index, using event study methodology.

While their focus extended beyond the Nasdaq Nifty correlation, their findings highlighted

the interconnectedness of global markets and emphasized the need to consider external

factors in market analysis.

Overall, these studies collectively offer valuable insights into the correlation between the

Nasdaq index and the Nifty index within the Indian context. They underscore the importance

of both short-term and long-term perspectives in understanding the dynamics of this

relationship, providing valuable implications for investors and policymakers.

Methodology and Data:

Data Collection:

Secondary Data: Historical data spanning eleven years (2013-2023) was collected

from the official websites of the National Stock Exchange (NSE) for the Nifty index

and the NASDAQ for the Nasdaq index.

Daily Open and Closing Prices: Data points for daily open and closing prices were

gathered for both indices.

Data Preparation:

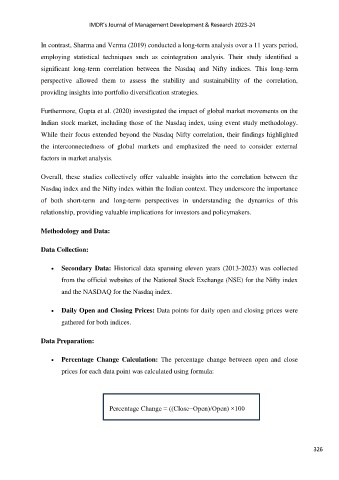

Percentage Change Calculation: The percentage change between open and close

prices for each data point was calculated using formula:

Percentage Change = ((Close−Open)/Open) ×100

326